The Entertainment Strategy Guy breaks down Netflix’s 2020 with an emphasis on statistics of its shows and how it performed from a business point of view.

If I had gone into a coma and woke up at the end of 2021, I would not have believed my eyes when I read Netflix’s 2020 annual report.

Not only had Netflix continued its subscriber growth from the previous years (growing by 22% year over year compared to 20% growth the year before), but Netflix was cash flow positive for the first time since 2011. Even more, they did it without either of their two biggest series, Stranger Things and The Witcher!

I’d have been astounded.

There is usually a tradeoff between growth and cash flow. And Netflix was growing and making tons of money. Of course, upon waking up from this coma, you’d also have to tell me that there was a global pandemic that locked folks in their homes for months on end, ended all theatrical distribution and live performances, and sent the world into a recession.

Huh.

That’s the crazy thing about reflecting on 2020 for Netflix. This was arguably one of the best years in the company’s history, but it occurs during a once-in-a-century (let’s hope!) pandemic.

So let’s review the year that was for Netflix. I’ll go quarter-by-quarter, highlighting the top content, business news and general events that impacted the streamer of record. Then, I’ll explain where the stock price went from there.

Q1 2020 – The World Goes Into Lockdown, and Netflix Has Their Most Popular Content

Top Shows: Ozark, Tiger King

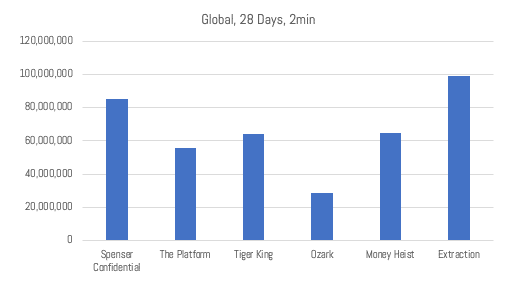

Top Films: Spenser Confidential, The Platform

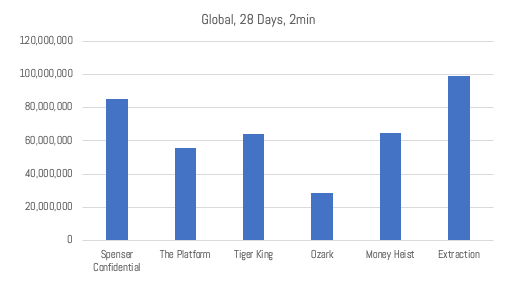

Starting in March, Netflix released a string of shows that would end up becoming some of their most popular of the year, including Tiger King and Ozark in the United States around the globe. In December, I anointed Tiger King the most popular show of 2020 in America:

For data hounds such as myself, Netflix also started releasing a buzzy new metric about their shows: daily top ten lists for film, TV and all content. With the caveat that we still have no idea how Netflix measures this, it’s allowed some groups to track what is the most popular content on Netflix over the year. Here’s FlixPatrol’s take on the most popular shows/films in 2020:

While Netflix couldn’t have known it was coming, they happened to be releasing some of their best content right when the world would need it. March was when most nations around the world entered Covid-19 lockdowns if they weren’t in them already. As such, TV usage boomed and streaming shot up with it.

Yet, if folks were stuck at home, that included the actors, directors and staff needed to make TV shows and movies. This meant that Netflix, like most studios, had to pause productions around the globe. However, with theaters being closed, most studios needed a new home for a lot of films that weren’t worth holding for a year or more. Netflix was the beneficiary of this, buying the rights to even more films it would debut throughout the year like The Lovebirds and The Trial of the Chicago 7.

Add it all up and Netflix had one of their best quarters for global subscriber growth, adding 15.8 million new subscribers (9.4% quarterly growth) in one month!

The result? After starting the year at $326, and cratering with the rest of the stock market, Netflix’s stock price jumped to $444 before its earnings report. (It actually dropped a bit after the first quarter announcement because analysts were expecting an even bigger quarter.)

Q2 2020 – Netflix Shrugs Off New Competitors

Top Shows: Space Force. Too Hot to Handle

Top Films: Extraction, The Wrong Missy

The quarter started out really well for Netflix as they dropped their third most popular show Money Heist (La Casa de Papel), which continues to be a juggernaut of interest everywhere (except America). The run from Spenser Confidential to Ozark/Tiger King to Money Heist to the Chris Hemsworth helmed Extraction might be one of Netflix’s best in their history. After that, though, Netflix had one of its weaker runs of content with some of their expected hits failing to deliver results, like Space Force, Never Have I Ever and Floor Is Lava.

Not that it really mattered. Everyone was still in lockdown so they kept watching a lot of Netflix. Even with the weaker content slate, Netflix still added an impressive 10 million global subscribers (5.5% growth). That was two great quarters of subscriber growth in a row.

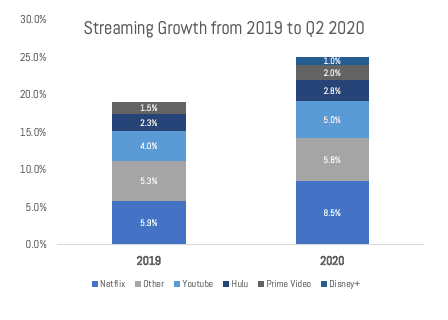

Moreover, Netflix beat back the first round of new entrants to the streaming wars. Quibi came and quickly found that even with billions in spending on new content, they couldn’t compete. (They announced they were shutting down in October of 2020.) Then AT&T launched HBO Max, mostly to shoulder shrugs from customers. Since most subscribers who wanted it already had HBO, the number of folks using HBO Max only got up to 8 million by the end of the summer. NBC Universal’s big new streamer, Peacock, also failed to make a dent since its biggest launch event, The Olympics, was postponed to 2021.

Netflix took advantage of this lack of competition and broke a record of its own: it finally started making money. After expecting to lose $1 billion dollars (give or take a few hundred million), Netflix announced that they expected to actually break even in 2020. By the end of the year, we would find out that these two were too conservative and Netflix actually made $1.8 billion in cash, the first time since 2011.

What drove this newfound cash flow? A few things. First, Netflix had two amazing quarters of subscriber growth. Second, marketing costs to acquire those subscribers dropped as well, both because customers were flocking to Netflix and because TV/digital advertising rates plummeted in the recession.

Bigger than all that, though, was the pause in production for almost half of the year, while still having a backlog of shows to air. It turns out that Netflix holds their films and shows for even longer than I had estimated, in some cases up to nine months or more. Meaning, that Netflix could pause their productions for months and still release new shows and movies throughout 2021. (Unlike, say, Disney+ which only had one show finished shooting before the production hiatus, The Mandalorian.)

The result? Netflix stock continued its upward trajectory, finishing at $526 before earnings, which dipped after the announcement to $494.

Q3 – Netflix Subscriber Growth Stalls Under a Weak Content Slate

Top Shows: Cobra Kai, The Umbrella Academy S2, Lucifer.

Top Films: Old Guard. Kissing Booth 2, Enola Holmes

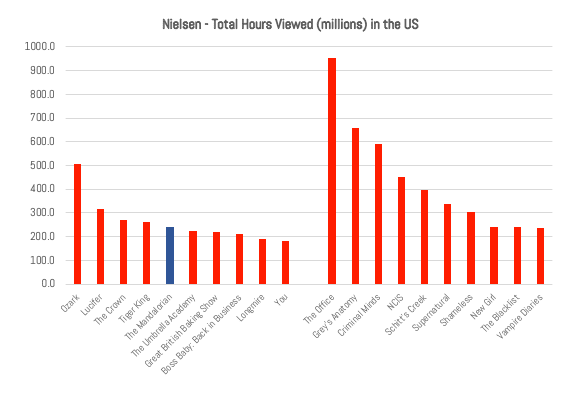

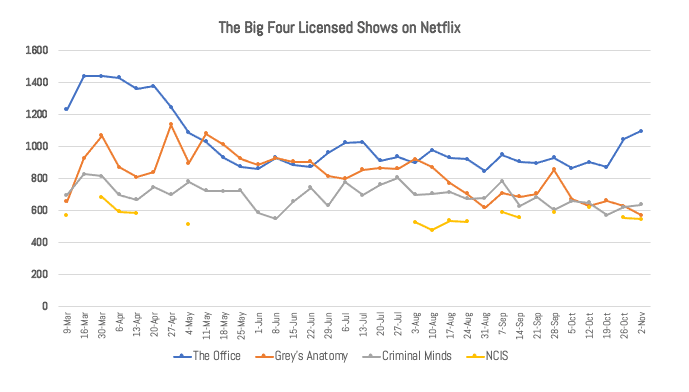

For Netflix observers like myself, August 2020 had a new milestone as it was the first time we finally had a third party company providing ratings data for Netflix. Specifically, Nielsen started releasing a weekly top ten of the most popular content in streaming by total minutes viewed. This allowed me to track, for example, how popular the top four licensed series were on Netflix:

Unfortunately, Nielsen doesn’t provide ratings outside of the United States. However, it’s the best non-Netflix continuous look we have at Netflix’s viewership yet.

The story of the third quarter was that Netflix finally had a weak—for them—quarter for content. They still had buzzy films and shows that tens of millions of folks watched, like The Old Guard (78 million viewers watched 2 minutes in the first 28 days), Enola Holmes (76 million) or The Umbrella Academy season 2 (43 million subscribers).

But other competitors finally started taking a bite of subscribers, especially in a few given territories. Hamilton was a ratings smash in the United States. And The Boys was a global sensation. I called each “The winner of the month” in my regular column at Decider.

This led to the worst quarter of the year for Netflix. After estimating low subscriber growth, they “only” grew by 2.2 million subscribers (1.1% quarterly growth) and missed their growth forecast. As they acknowledged, instead of smooth growth, the Covid-19 lockdowns accelerated growth in Q1 and Q2, meaning folks who would have subscribers later in the year decided to do so when lockdowns happened.

The other news was executive transition. In July, Netflix announced that Ted Sarandos would join Reed Hastings as “co-CEO”. In this new role, Sarandos changed up his development teams, replacing former TV head Cindy Holland with Bela Bajaria as the new head of television. This news was a pinch surprising given that Netflix has claimed lots of success in TV, yet still felt a need to change leadership teams. Netflix calls this the “keeper test”, and if you don’t pass Hastings has often let even very senior people go.

The results? Netflix had its biggest slip of the year, going into earnings at $528 per share and a week later dipping to $486. Until the end of the year, Netflix would hover around $500 per share.

Q4 – Netflix Finishes 2020 Strong

Top Shows: Bridgerton, The Queen’s Gambit, The Crown season 4

Top Films: The Midnight Sky, Christmas Chronicles 2.

And they were back! Netflix finished off 2020 on a streak of content almost as good as their March to April run. Starting with The Queen’s Gambit, Netflix had buzzy shows generating lots of views. In addition, Netflix aired their usual slate of “prestige” films competing for end of year awards, like the Oscars. Unlike other years, Netflix is one of the only studios actually releasing films!

The streaming wars also heated up in December as competitors threw their best shots yet at Netflix. Netflix released Shonda Rhimes first show Bridgerton under her overall deal on Christmas Day, and it went up against Soul at Disney+ and Wonder Woman 1984 on HBO Max. That was a titanic battle that the theatrical films likely won, but just barely.

That said, Netflix returned to growth, adding 8.5 million global customers (4.4% growth) and again besting their forecast. And Netflix improved its financials across the board, increasing revenue from $20.1 to $24.99 billion (21.5%), profit increasing from $1.8 to $2.7 billion (48%) and global subscribers from 167 to 203.7 million (22%). Moreover, Netflix had managed to get to full-production by Q4.

And as I said above, Netflix experienced a free cash flow positive year for the first time since 2011. Crucially for investors, Netflix announced that in 2021, it expected to break even and remain cash flow positive going forward. Frankly, this is the best news for Netflix of all the big headlines. With this announcement, Netflix will no longer have to take on debt. Now, the next step is as important for Netflix—making huge free cash flow like their tech peers—but this was the first step.

The Result? Netflix achieved its highest stock price yet, of $582 dollars for a market capitalization of nearly $250 billion.

(The Entertainment Strategy Guy writes under this pseudonym at his eponymous website. A former exec at a streaming company, he prefers writing to sending emails/attending meetings, so he launched his own website. Sign up for his newsletter at Substack for regular thoughts and analysis on the business, strategy and economics of the media and entertainment industry.)