Following the Netflix Earnings call yesterday, here are a few thoughts from a kids’ perspective. Before diving in, here’s a recap on a few big news stories that have happened recently and how they relate to kids.

Netflix Kids Top 10

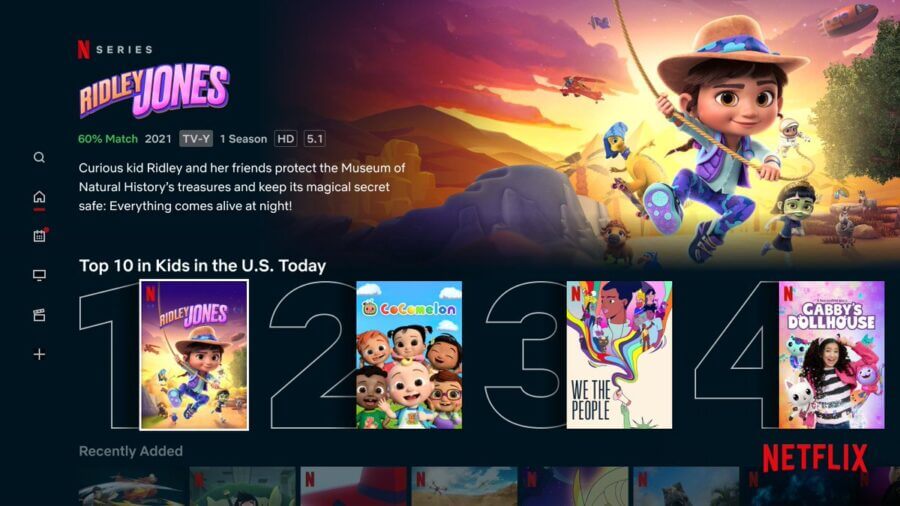

A new, dedicated Kids Top 10 was launched in the last few weeks. This consolidates series and movies into one list. They seem to be working out a few technical kinks but the good news is that it will give a longer tail on the performance of kids’ content. Reasons behind this are worth consideration, the main benefit being content discovery for members. Might the next step be Top 10s across genres? Top 10 documentaries? Dramas? Stand-up comedies?

Kids’ content remains in the overall Top 10 for now. It does, however, occupy valuable visual real estate that isn’t relevant to all members. Kids’ movies (many from Dreamworks/Illumination more on that in a sec) dominate film Top 10s globally, and CoComelon remains a firm fixture in the series Top 10 for many markets. Having said that, we recently learned that 60% of members globally watch kids/family content. Perhaps that delivers a critical mass of interest to keep it there.

Netflix Kids Top 10

It feels like programming/discovery on OTT services still has a long way to go, even for folks doing it for as long as Netflix has. They referenced their recently launched “Play Something” feature in earnings collateral. This algorithmically picks something for you to watch. This throws up the question why not linear barker channels that give an opportunity to sample? You can see this working for parents and kids, particularly pre-schoolers.

Alongside the Kids Top 10, Netflix are also launching a biweekly Kids Recap Email for parents. It will be sent to members with at least one kid’s profile set up, and give details on what content is being watched. In addition to this, there will be recommendations and tips for using the platform’s features.

Netflix Kids Content News

Big content news this quarter was the extension of the Netflix/Universal animated film deal. This guarantees Netflix multi-year access to Dreamworks and Illumination titles, including the next installments from IPs like Minions and Shrek. Many of their predecessors are long-term campers in the film Top 10, as mentioned above. This is fantastic news for the Netflix kids’ strategy. Between this, and their excellent relationship with Sony Pictures Animation, they are assured of big hit kids’ films for the next few years. Their own in-house film slate is still finding its feet in terms of generating a slam dunk/franchise.

Other big content news was a new deal with Moonbug Entertainment. This includes the green light of new original series for CoComelon and Little Baby Bum. Whatever way you dice it, CoComelon has been a huge hit for Netflix. The new series of 24×7’ is expected to hit in 2022.

So yes, lots going on in Netflix and the world of kids. Analyst Rich Greenfield of LightShed Ventures summed this up in one of his 10 Questions for Netflix’s Q2 2021 Earnings Interview:

Is Kids Content Impacting Discovery? The Top 10 list feels like valuable real estate that too often is overwhelmed by Kids content that is not relevant to teen/adult viewers. You recently rolled out a dedicated Top 10 for Kids. With titles like CocoMelon having been in the Top 10 for a year and Kids movies regularly in the Top 10, was the goal to exclude Kids content from the broader Top 10 most watched list? Also curious how your Kids programming strategy is evolving following the expansion of your Universal animated output deal and a new CocoMelon spinoff working with Moonbug.

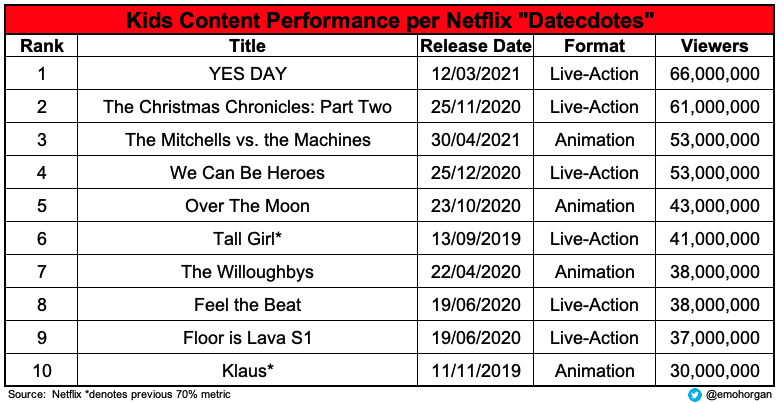

New Kids’ Content Performance Data

Looking at content performance, we had 2 new Kids datecdotes this quarter. The beautiful relationship with Sony Pictures Animation produced the “biggest Netflix animated film to date” with The Mitchells vs The Machines. 53 million members watched the film in its first 28 days. We also got the first performance nugget on a Netflix kids’ series. Floor is Lava, launched in 2020, was watched by 37million members, earning it a season 2. The updated ranking of kids’ content performance per Netflix released viewership is below:

Upcoming Kids’ Content

The next film from Sony Pictures Animation, Vivo, got a mention. The title character, a musical honey bear, is voice by Lin Manuel Miranda who also wrote the soundtrack. It’s a busy time for Miranda, he’s involved in Encanto, coming from Walt Disney Animation Studios in November. Other notable kids’ films coming this quarter include My Little Pony: A New Generation and The Loud House Movie.

We’ll also be looking closely to see if there is any viewing figures release for Ridley Jones, the newest Netflix pre-school show from creator Chris Nee. This has seen an innovative distribution strategy, with its first episode premiering on YouTube.

And finally:

There has been lots of discussion on Netflix’s moves into the games market. In this earnings, they specified that this had a particular focus on mobile. They see this being built out long term, in the way they’ve built out new genres in the past. The idea is that the sum of the parts of games, consumer products, and other supporting elements builds Netflix into a must-have service globally.