Pictured: The Creature Cases, The Sea Beast, Chickenhare

We’re back to recap Netflix’s Q2 2022 numbers and how the streamer performed regarding kids’ content over the past 3 months.

It’s fair to say that Netflix’s Q2 earnings call this week did not deliver the melee of headlines and hot takes of Q1. Relief all round I’d say. The overriding feeling was that it was a bad day, but not as bad as they’d forecast, so a good day? You’d have to ask Reed Hastings. He was definitely quieter than normal on the call, but his letter to shareholders underscored Netflix’s affinity to binge drops and aversion to theatrical windows:

“This freedom means we can offer big movies direct-to-Netflix, without the need for extended or exclusive theatrical windows, and let members binge watch TV if they want, without having to wait for a new episode to drop each week.”

Netflix Q2 2022 Headlines

Subscriber Loss Continues!… but at lower rates than forecast, which is a good thing, I guess. The devil in the detail here is that it seems the Netflix penetration ceiling has been reached in the U.S. and Canada where the subscriber decrease was more pronounced.

Don’t have time to get into this on Twitter, and excited to listen to the call later, but I would very much argue the bigger story is not a loss of 970k subs globally; it’s -1.3M subs in UCAN, after -640,000 in Q1, after a very small 1.19M add in Q4 (typically its best quarter).

— julia alexander (@loudmouthjulia) July 19, 2022

‘Stranger Things 4’ Did Banging Business!… No surprises there. The series was heralded as a perfect example of “The Netflix Effect”; there may have been sniggers from some about this.

Just like Winter, Advertising Is Coming!… There were more details on the advertising-supported tier following the announcement of the deal with Microsoft.

This will be rolled out in the most mature/lucrative markets first. Apparently, the integration of advertising is very much going to be an evolution. Also, most licensing deals with content partners include AVOD rights and not just SVOD rights, so no major headaches there – PHEW!

Account Sharing Crackdown Begins!… Last quarter, Netflix estimated that as many as 100 million households access the service via account sharing, representing an incremental 30% of their userbase. The first tests to try to monetize this were run in LATAM.

Overall Content Budget Has Reached Its Ceiling!… Netflix anticipates that their content budget, which had previously increased year on year, should now remain “in the ZIP code” of 2021’s $17 billion.

Netflix Kids Headlines for Q2 2022

The most notable news from a kid’s media point of view was press released just ahead of the earnings call. Netflix is acquiring independent Australian studio Animal Logic.

The company has a strong background in visual effects, supplying services to film franchises like The Matrix, Marvel, Harry Potter and The Lord of the Rings to name but a few.

Animal Logic logo

More recently the studio has been the producer of several commercially targeted family/animated movies, including Peter Rabbit, several Lego movies, and DC League of Super-Pets.

They were already in play at Netflix as partners on upcoming animated features The Magician’s Elephant and Ron Howard’s animated directorial debut, The Shrinking of Treehorn.

The value broadly targeted animated films can deliver for streamers has been well demonstrated. Once kids buy-in, the repeat factor of these movies keeps on giving. Whilst there’s been no question that Netflix-produced Originals in this genre have reached the gold standard creatively, the ongoing engagement that titles like Over the Moon and Back to the Outback have delivered is less obvious. One would assume that the hope with the Animal Logic acquisition is to deliver Netflix slam dunk animated hit(s).

What kids movies performed well on Netflix in Q2 2022

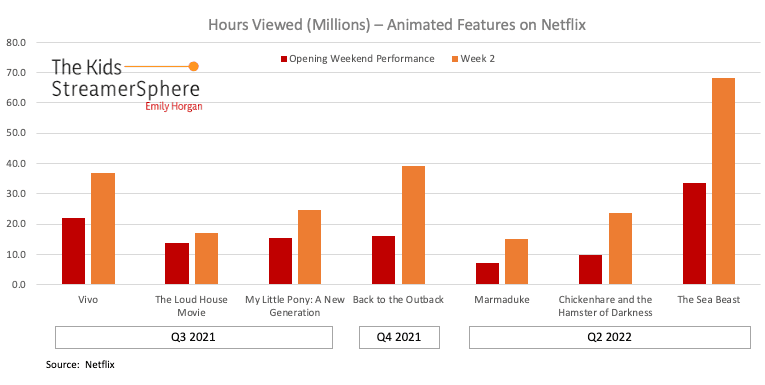

Excellent engagement has been seen thus far for Netflix’s recent animated feature The Sea Beast, which was referenced multiple times in earnings.

This swashbuckling, daring family adventure has enjoyed great reviews. It has also seen a veritable plastering at pole positions on the general Trending Top 10 ranks (not just the kids Trending Top 10) in all markets since it premiered on July 8th (technically not Q2, but let’s not get that nitpicky). Director Chris Williams has a stellar pedigree from Walt Disney Animation Studios, where he was a central creative in both Big Hero 6 and Moana.

Performance per Netflix Global Top 10 looks better than convincing, based on comparable animated titles; The Sea Beast has quite a tidal wave of a build.

Fair caveat that these numbers don’t go back as far as The Mitchells vs The Machines or Over the Moon, arguably the two titles with the same blockbuster marketing treatment.

For that comparison, we’ll have to rely on U.S. Nielsen Streaming Content Rating numbers when they come through.

Netflix Movie Performance for Q2 2022

Another thing worth noting in film results this quarter is that Paramount property Sonic the Hedgehog enjoyed eight weeks of Netflix Global Top 10 featuring across April and May. This was clearly coasting on awareness driven by the theatrical release of the sequel, Sonic the Hedgehog 2, which drove an excellent post-COVID box office take globally.

The compounding, multi-faceted value of family film franchises strikes again. So does Paramount Global’s “feck it sure we won’t bother holding the rights exclusively for Paramount+, it’ll get more eyeballs this way which is practically free marketing” strategy (internally, it’s known as the FISWWBHTREFP+IGMETWWIPFM strategy, naturally).

What kids series performed well on Netflix in Q2 2022

The world of Netflix’s kids TV series was hacked at like an unwanted bush in a garden after last quarter’s earnings. Bone, Toil and Trouble, The Twits, and Chris Nee’s Dino Daycare were all mercilessly canceled.

Even Meghan Markle wasn’t safe—her series Pearl also hit the cutting room floor—and these are only the series that were publicly announced.

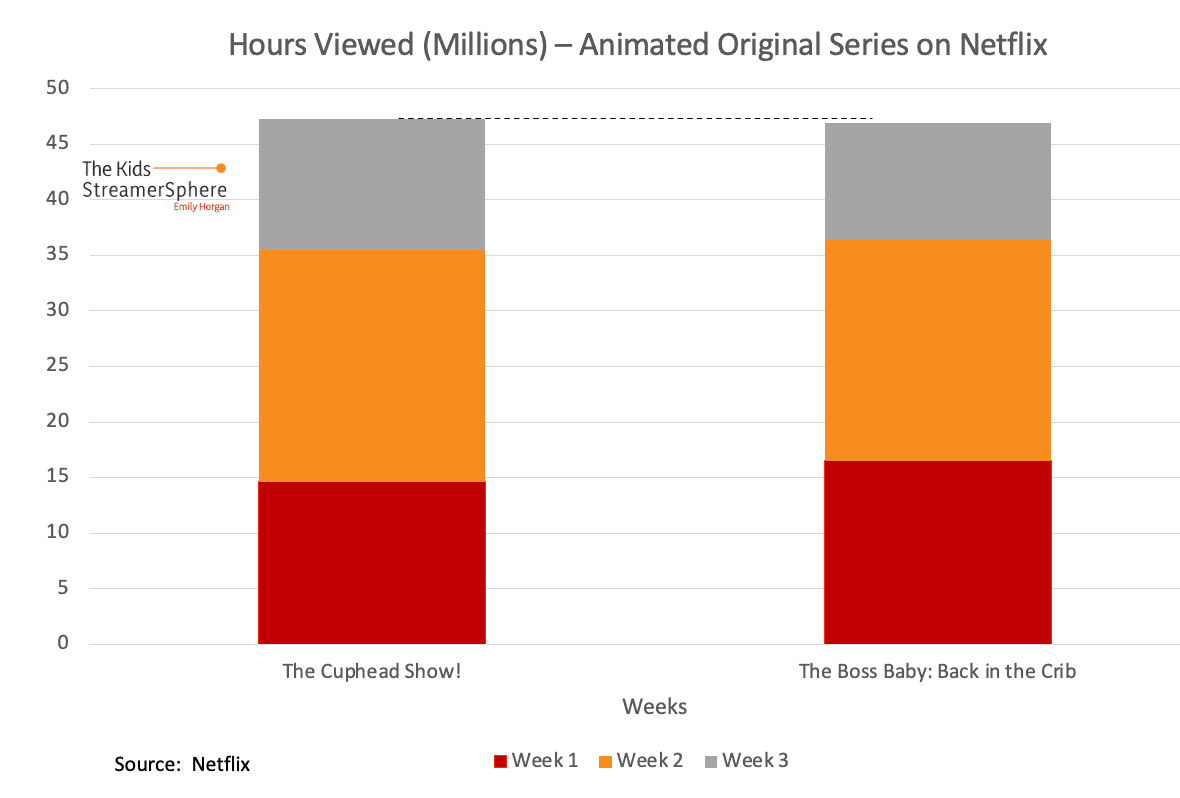

Amongst this turmoil, The Boss Baby was reported from multiple sources as an ideal example of a Netflix animated series, delivering the right size of performance numbers. Interestingly enough, the series spin-off, The Boss Baby: Back in the Crib, hit the service this quarter, showing up decent results. It was, however, pipped by a hair on nose by The Cuphead Show!, a wacky, old-school-styled comedy, which is far more in the realm of the types of animated series Netflix previously commissioned.

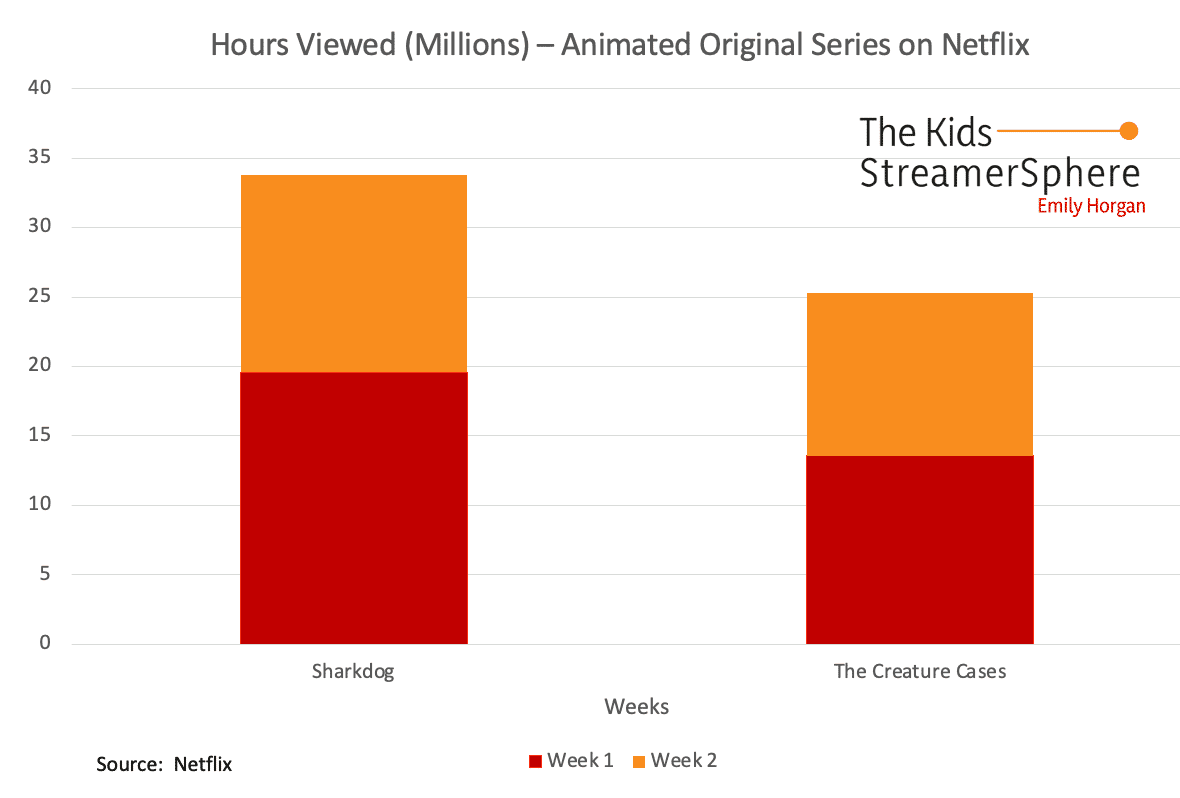

Another breakout in the Netflix Global Top 10 was the preschool series The Creature Cases, which featured across two weeks. From Silvergate Media, and described as “X-Files for preschoolers,” the show also had strong featuring in the Kids Trending Top 10. It didn’t hit the heady heights of Sharkdog but all context is welcome as we try to build a picture of what good for preschool looks like based on Netflix’s metrics.

Another thing worth noting for the series is the recent prevalence of family-friendly live-action series that sit across both the general and the kids sections. Is It Cake? and Man vs Bee have seen multi-week featuring in the Netflix Global Top 10, presumably enjoying some uplift from their universal availability.

What’s next for Netflix Kids?

Although the Animal Logic acquisition is a valuable asset for the future, it will be a few years before their pipeline of animated films is firing on all cylinders for Netflix. The development of animated features takes time.

A number of animated movies originating from Europe were also announced at the recent Annecy festival.

In the meantime, My Father’s Dragon from Cartoon Saloon is another major animated feature that was announced for the slate for this year.

On the live-action front, 13 The Musical is a big one that hits next month. Has 2022 felt lighter for slam dunk live-action films for the streamer, or is that just me?

For series, Kung Fu Panda: The Dragon Knight came in strong in its first week last week—particularly for a derivative from a film series that has been dormant in recent years. Perhaps Netflix are on to something with this whole “be like DreamWorks” thing?